Fresha Capital: flexible funding to power your next move

Running a growing business means making big decisions, fast. Hiring the right people, stocking up on products, upgrading equipment, expanding your space, or ramping up marketing at the perfect moment. But cash flow doesn’t always line up with opportunity.

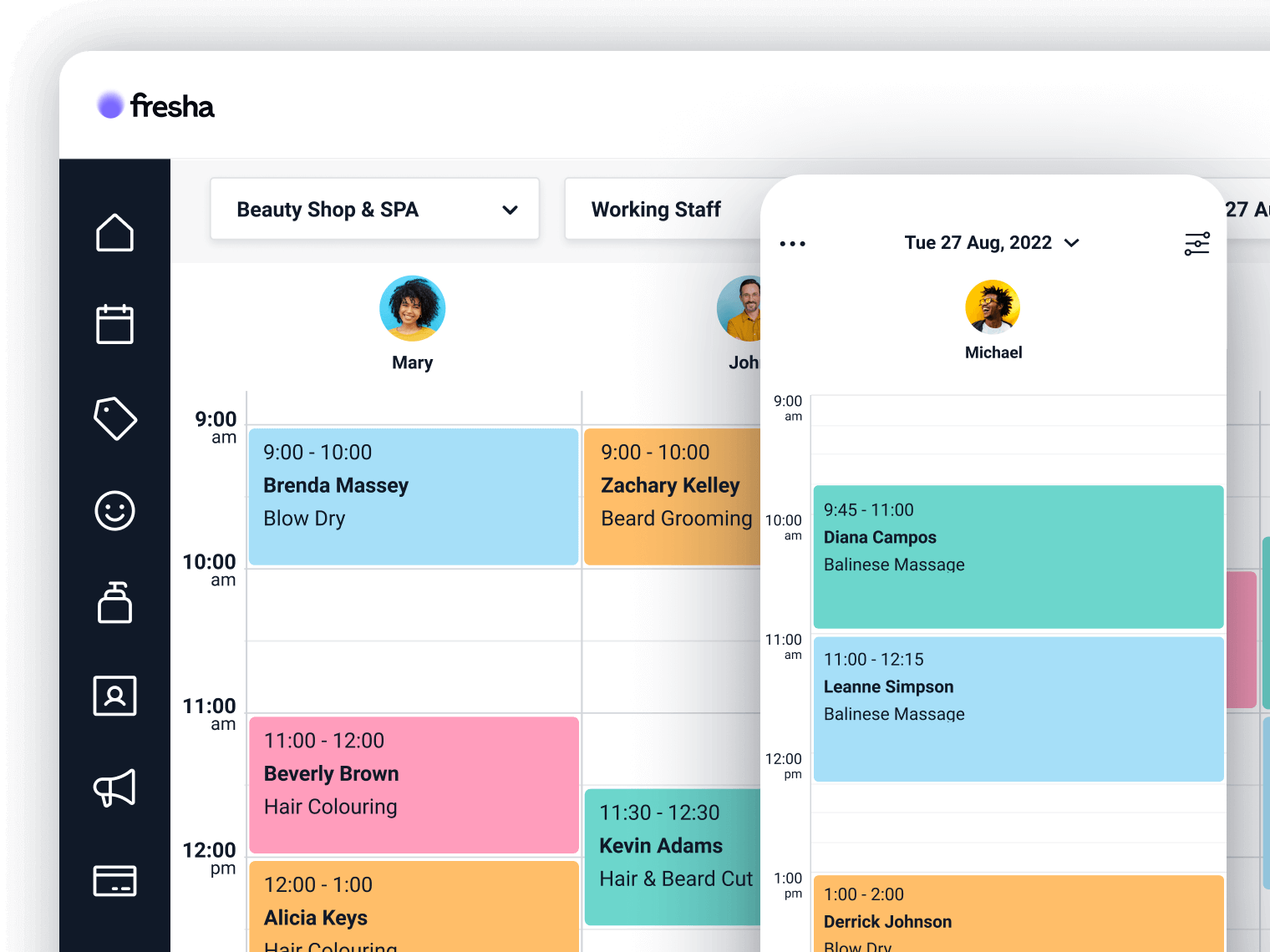

This is where Fresha Capital comes in: fast and flexible funding that is seamlessly built into your Fresha workspace, designed to help keep your business moving even in the toughest of times.

Backed by Adyen, the global fintech platform trusted by leading brands worldwide, Fresha Capital is helping unlock working capital for SMBs across the selfcare space, from salons to barbershops, spas, and wellness studios. With this, we’re working to support Fresha’s 140,000+ businesses and 450,000 individual professionals, who facilitate over 35 million appointments each month.

Support your growth with fast and flexible business loans

Fresha Capital gives you fast, flexible funding tailored to your business, so you can invest in growth exactly when you need it. With instant approval and funds landing in minutes, you can move quickly when it matters most, without long waits, complicated paperwork, or uncertainty.

You can use Fresha Capital for the moments that matter, like replacing essential equipment before a peak weekend, hiring additional staff ahead of a busy season, expanding your services, or upgrading your space.

Funding that works the way your business works

Unlike traditional lending, Fresha Capital is designed to fit seamlessly into your day-to-day operations, so you can access funding when you need it and repay in a way that works with your sales.

As Hemmo Bosscher, SVP Global Head of Platforms & Financial Services at Adyen, shared:

“Our relationship with Fresha shows how embedded payments can be a catalyst for strategic change. Fresha partnered with us to embed payments directly into their platform, with embedded lending, they’ll be introducing another new revenue stream and deepening relationships with their customers across several key markets.”

Some key benefits include:

Quick access to funds: Users can view pre-approved offers and request financing in seconds, with funding accessible within hours or the same business day. Payout to external banks typically takes minutes, though it may take up to two business days depending on the bank.

Simple process, flexible amounts: Loan offers range from £500 to £50,000 (in supported currencies), pre-approved based entirely on sales performance, eliminating the need for lengthy applications or paperwork.

Transparent and flexible repayment: Repayment is automatically adjusted as a fixed percentage (ranging from 1% to 15%) of daily sales, meaning businesses repay more when they earn more and less when they make less. The loan term is up to nine months, and there are no fees for early repayment or late payments.

Speed and simplicity in a loan can make all the difference when something unexpected happens, especially in an industry where things can’t always wait. As Pawel Iwanow, Chief Payments Officer at Fresha, explained:

“Our partnership with Adyen allowed us to roll out Fresha Capital in just weeks, scaling fast across seven global markets.”

“With over $5.5 million already issued, it’s clear that access to funding is often the primary barrier for beauty and wellness SMBs. If a vital piece of salon equipment breaks on a Friday before a peak weekend, we can now authorize a loan in seconds, saving the day for our partners and unlocking growth they would have otherwise postponed.”

For Fresha partners, that real-time access to funding can be the difference between slowing down and staying on track. Mark Maciver, CEO & Founder at SliderCuts, shared his experience:

“When a major refurbishment went over budget, I had no financial buffer left and needed quick access to capital to keep the business moving forward. The speed of Fresha Capital was on a completely different level, with the funds available the same day.”

So, whether you’re planning your busiest season, opening up new appointment slots, adding new services, or making improvements your clients will love, Fresha Capital helps you unlock funding without slowing down your momentum.

Fast. Flexible. Transparent.

That’s funding built for modern businesses, and built right into Fresha.

Fresha Capital is launching now. Keep an eye out in your account…

Read more about Fresha Capital on the Fresha Help Centre.

Eligibility requirement: To access Fresha Capital, you’ll need to be using Fresha Payments, as offers and repayments are based on the payments you process through Fresha.

*Fresha Capital is currently available in selected regions.