Fresha CEO William Zeqiri Takes the Stage at Money 20/20: Unlocking the Invisible Engine Behind SMB Success

This month, Fresha’s CEO and founder, William Zeqiri, took center stage at the Money 20/20 conference in Amsterdam, one of the world’s most influential events in fintech and payments. Speaking at a fireside chat with Joëlle Bønding, VP Global GTM Strategy of Adyen on “The Invisible Engine Behind SMB Success,” Zeqiri shared insights into how Fresha’s integrated payment solutions are empowering millions of small business owners across the globe. “Small businesses are the backbone of every local economy,” said William. “At Fresha, our mission is to make it radically easier for service-based businesses to run, grow and succeed without the headaches of fragmented financial tools.”

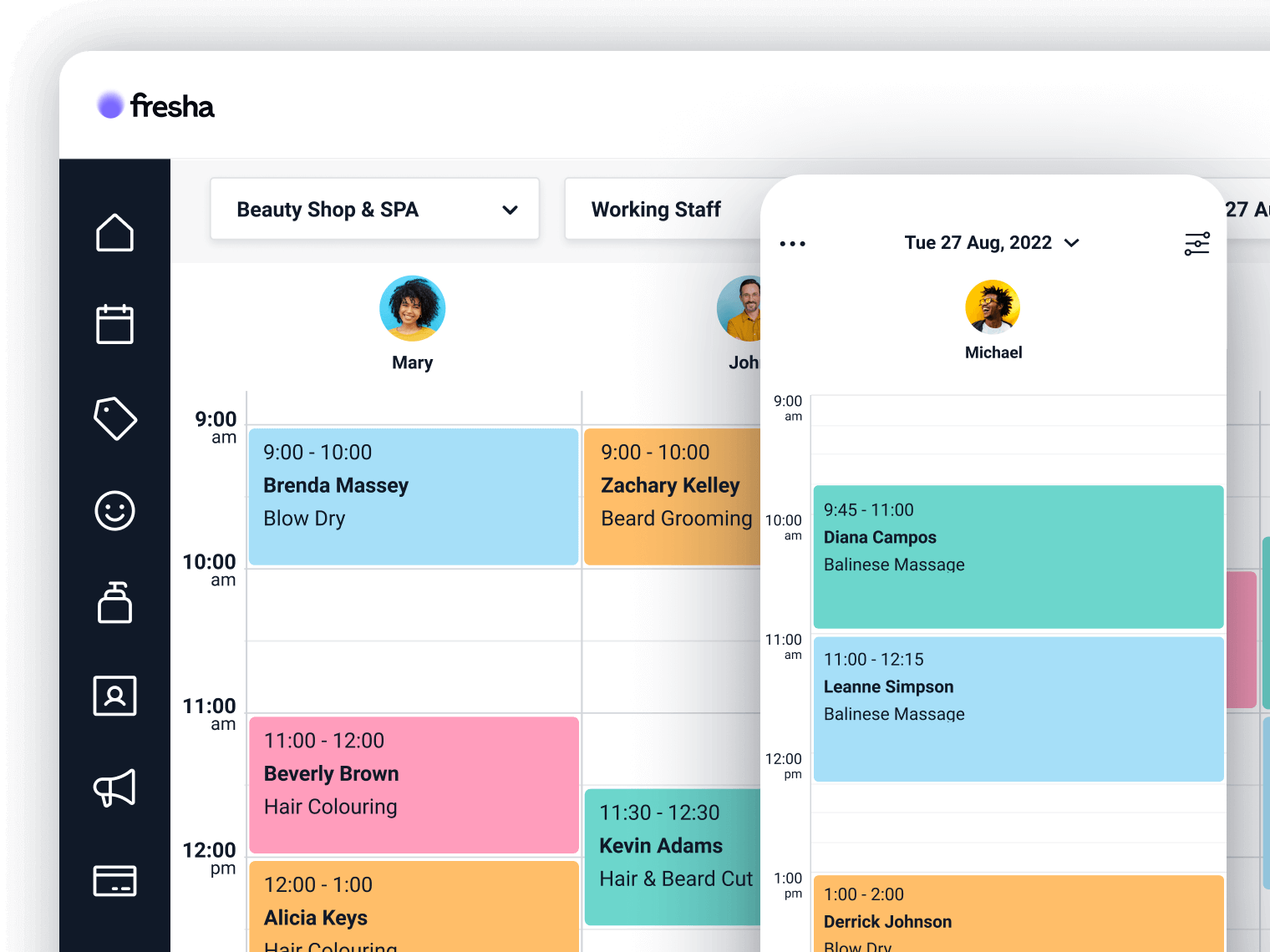

During his talk, Zeqiri highlighted several new payments-driven features Fresha has recently introduced aimed at simplifying the financial side of running a business, so owners can focus more on delivering exceptional client experiences.

“What we’re building isn’t just a software platform, it’s an ecosystem,” Zeqiri told the audience. “One where everything from bookings to banking is connected, automated, and designed around the real-life needs of service-based businesses.”

One key innovation is how Fresha now supports self-employed independents, allowing businesses to work flexibly with freelancers or contractors. Payments can be split automatically at checkout, sending the right amount to each team member instantly without manual admin required. “It’s another way we’re helping businesses adapt to the modern workforce,” Zeqiri noted. Throughout 2025, even more Fresha tools will be launched to make it even easier to manage hybrid teams.

Another major feature is the ability to manage payroll within Fresha. Now, instead of switching between platforms, business owners can run payroll for their entire team, handling taxes, commissions, and salaries, all in one place. It’s a huge time-saver, especially for busy salon and spa owners who’ve traditionally relied on multiple disconnected systems.

And as part of helping small businesses protect their business from no shows and cancellations, Fresha allows business owners to set up flexible payment policies. By being able to take upfront payments, and charge cancellation fees, business owners can protect their cashflow. And in the coming months, Fresha will launch the ability for business owners to tailor payment policies depending on clients and services, so they can collect upfront payments from only new customers, or just for appointments over a certain value.

To support staff motivation and customer engagement, Fresha has expanded tipping options. Clients can tip via QR codes, before appointments, or even increase their tip after the service is complete, giving clients more freedom to show appreciation, and team members more ways to earn.

Finally, Zeqiri shared how Fresha’s tools for tracking team and location performance are helping business owners set and monitor revenue targets, enabling smarter, data-driven decisions. Whether it’s spotting high-performing staff or identifying areas for improvement, these insights are proving essential for growth-minded businesses.

“Our mission at Fresha has always been to eliminate friction for small business owners,” Zeqiri said in closing. “When payments, banking, and operations flow invisibly in the background, entrepreneurs can stay focused on what really matters: creating amazing experiences for their clients.”

As Fresha continues to expand its ecosystem of tools, the message from Money 20/20 is clear: the future of small business finance is frictionless, integrated, and powered by platforms that truly understand the industry from the inside out.